Twins' yearly revenue from day-to-day baseball operations

On a year-over-year basis, the Minnesota Twins are largely a profitable enterprise. According to the latest estimates, the Twins profited an estimated $5.2-$43 million in operating income from the 2016-2025 fiscal seasons. Taking out the anomaly of the pandemic year, they've only operated in the red one season. Operating income, simply put, is the profit a business makes from its core operations. In the Twins case, it's the revenue from ticket sales, concessions, merchandise, and their media deals, minus expenses like their carefully managed player payroll, staff salaries, travel, and stadium operations. While this profit margin is slim, indicators are that the team's day-to-day yearly baseball operations do not generally operate at a loss or accumulate debt on its own.

The team currently generates around $356 million in annual revenue. Despite this being ranked in the lower tier of MLB franchise valuations, the Twins remain a fiscally solid run organization.

Long-term debt loans

This debt is not from losing money on player or personnel salaries. Just like any homeowner the Twins carry a "mortgage" of sorts on Target Field. This is where a majority of the Twins debt lies. Like most major professional sports teams that have built stadiums, the Minnesota Twins organization carries an amount of long-term debt that's paid off over time. Recent reports have placed this figure in the range of $400 to $425 million, though high, it's not uncommon. The debt is allegedly from two major sources:

- Stadium Financing: When Target Field was built, it was a public-private partnership. The total cost was approximately $555 million. While Hennepin County covered a large portion through a sales tax, the Twins organization was responsible for roughly $195 million. This large capital expenditure was interest-financed, creating a long-term debt obligation, much like that mortgage on a house.

- League-Wide Credit Fund: Major League Baseball allows teams to borrow from a Central League Credit Fund for major capital improvement projects and other long-term investments. So for the Twins, scoreboard and facility upgrades are a source of long-term debt. It is common for teams to carry debt on their books from this entity.

Long-term equity and current valuation

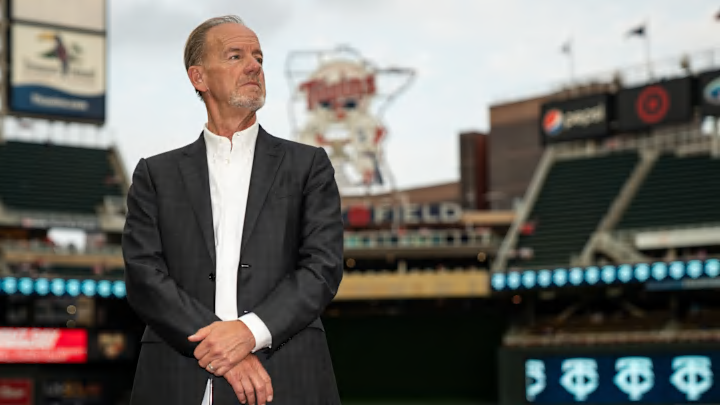

With any successful business, a large profit comes in the form of selling the business. Carl Pohlad purchased the Minnesota Twins in 1984 for $44 million. With an annual compounded growth of 3-11%, as of 2025, the Minnesota Twins are valued at approximately $1.4-1.65 billion. The Pohlads are in a very profitable position with their long-term equity.

The Pohlads listed the team for sale in late 2024, reportedly seeking offers near $1.7 billion. Bids around $1.5 billion have already been rumored to be turned down due to the fact that the Twins want the buyers to "add" on or pay off the long-term debt loans as a part of the purchase, which does appear to be a sticking point for buyers.

Is there debt from "other companies?"

This is an important distinction as it's rumored the Pohlads are rolling debt from their other businesses. The Minnesota Twins are owned by the Pohlad family through the Pohlad Companies, a large, diversified holding company with interests in banking, real estate, automotive sales, and more. The finances of these other businesses appear to be legally separate from the Minnesota Twins. While the overall financial strength of Pohlad Companies provides a stable backing for the team, the debts of their outside ventures do not seem to be linked to the Twins' books. The estimated $400+ million debt figure is specific to the baseball franchise itself.

Summary

* Are the Twins "in debt" from running the team year over year? No. They are estimated to run a modest operating profit from their baseball business.

* Do the Twins as a corporation have long-term debt? Yes. They carry a long-term debt of over $400 million, largely tied to the financing of Target Field and other capital improvements. The Twins appear to be adding the debt on top of valuations to maximize the profit of the sale.

* Do the Twins have a solid equity and resale valuation? Yes. The Twins have very solid equity and value of approximately $1.5-1.7 billion, up from an initial purchase of $44 million.

* Are the Twins in debt from other Pohlad-owned companies? No. The team's debt appears to be separate from the other entities under the Pohlad Companies umbrella.

You can't overlook the long term debt, but the Twins are in a very solid financial position. The Pohlad family will come out well in the sale if and when it happens. Any buyer can look back and ahead, to see the valuation of the franchise should continue to rise in the years to come.